Insurance Companies

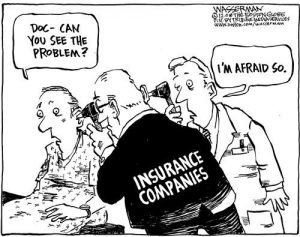

The plot twist storytelling technique, which relies on introducing a radical change in the direction of a plot to shock the reader, is difficult to execute in a satisfying manner. More often than not, readers are disengaged by the technique for a variety of reasons ranging from introducing too little change to ruining an already interesting story. When done right, however, it is a different story, For instance, the Portal game franchise by Valve corporation is consistently ranked among the best games of all time by experts like IGN for “undoubtedly coming out of nowhere and shattering the mold”(1). In the second installment of the franchise, the player’s ally is revealed to be the main antagonist of the game after the player assists his rise to power. Similarly, the big baddy of single-payer healthcare prefers to stay in the shadows and manipulate the outcome to their favor. Out of all the issues preventing the implementation of single-payer healthcare discussed on this website, the biggest opposers are health insurance companies. Regardless, the time when insurance companies could hide in the shadows draws to a close as the public slowly realize that their opinions were controlled by insurance companies for the sake of profit.

Health insurence profits

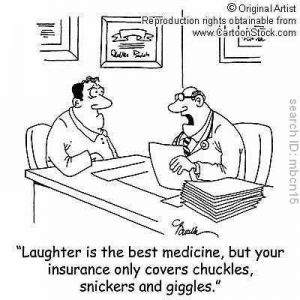

In order to expose health insurance companies, it is important to first estimate their profits after the implementation of the Affordable Care Act (ACA). According to data presented to The Council of Economic Advisers in an article titled “The Profitability of Health Insurance Companies.” in March 2018, insurance companies suffered significant financial losses in the individual market. To make up these losses, insurance companies used government tax credits to pay for rising premiums. Another indicator that insurers leeched taxpayers, is that enrollment levels remained consistent as premiums rose. Meanwhile, the Medicaid expansion, which provides federal financed care through private insurers, opened room for large insurers failing to cope with the new individual market to profit in the Medicaid market. In other words, as the ACA Medicaid expanded so did the opportunities for insurers to profit. As a result, health insurance stocks outperformed the S&P 500 by a stunning 106 percent! The report ends on a ‘high note’ by stating that “all health insurers can expect to become more profitable this coming year due to the recent tax reform”(2). As shocking as this data is on its own, any dedicated researcher must consult a variety of sources. Therefore, I will include the data of two additional sources. Similar to the data presented to The Council of Economic Advisers, the 113th Congress received a report that “the total taxpayer bailout [to insurers] could, in fact, well exceed $1 billion this year alone”(3). This more evidence that health insurers used taxes to pay for premium raises. Another scholarly article written by Professor Claudia Chaufan and released in the International Journal of Health Services informed readers that the ACA increases health spending by about $1.1 trillion. In this case, health insurance companies are not solely responsible for the $1.1 trillion raise, but they definitely played a part. In essence, even though it is impossible to get a set number, data from various sources indicate that the profits of health insurers skyrocketed after the ACA without any improvements in care quality.

Footnotes:

1.“Top 100 Video Games of All Time – IGN.com.” Accessed May 16, 2020. https://www.ign.com/lists/top-100-games.

2.“The Profitability of Health Insurance Companies.” The Council of Economic Advisers, March 2018. https://www.whitehouse.gov/wp-content/uploads/2018/03/The-Profitability-of-Health-Insurance-Companies.pdf.

3.“House Hearing, 113th Congress – POISED TO PROFIT: HOW OBAMACARE HELPS INSURANCE COMPANIES EVEN IF IT FAILS PATIENTS.” Govinfo, 18 June 2014, www.govinfo.gov/app/details/CHRG-113hhrg88826/CHRG-113hhrg88826/summary.

4.Chaufan, Claudia. (2015). WHY DO AMERICANS STILL NEED SINGLE-PAYER HEALTH CARE AFTER MAJOR HEALTH REFORM?. International journal of health services: planning, administration, evaluation. 45. 149-60. 10.2190/HS.45.1.l.