Overview

The history of the stock market dates back to the 17th century, when the first stock exchange was established in Amsterdam in 1602. The Dutch East India Company issued shares of stock to the public to raise capital for its trading ventures, and these shares were bought and sold on a stock exchange. This marked the beginning of modern stock markets, which have since become an important part of the global economy. In the United States, the New York Stock Exchange (NYSE) was founded in 1792, when a group of stockbrokers signed the Buttonwood Agreement to trade securities in New York City. The agreement was a response to a need for a more organized and regulated stock market, which had been growing rapidly in the United States. Under the terms of the agreement, the signatories pledged to deal only with each other and to charge a minimum commission of one quarter of one percent on all trades. They also agreed to refrain from trading securities that were not publicly held, and abide by rules that would govern their dealings. The Buttonwood Agreement helped to establish the principles of transparency and trust that are still fundamental to the operation of the modern stock market. It paved the way for the creation of the New York Stock Exchange, which became the most important stock exchange in the world. The NYSE grew to become the largest and most prestigious stock exchange in the world, and it played a central role in the growth of the American economy in the 19th and 20th centuries. Over time, other stock exchanges were established around the world, and today there are thousands of stock exchanges and trading platforms around the globe. This allows investors to buy and sell shares of stock in companies of all sizes and from all sectors of the economy.

The history of the stock market has been marked by periods of growth and innovation, as well as by crises and instability. The stock market has played a central role in the growth of the global economy, but it has also been subject to speculation, manipulation, and other forms of abuse. Despite these challenges, the stock market is still an important tool for raising capital, promoting economic growth, and creating opportunities for investors around the world.

There are many reasons the stock market is an important component of the economy. One reason the market is important is it provides a way for companies to raise capital by issuing shares of stock to the public. This capital can be used to fund new projects, expand operations, and basically invest more in the company to help it grow. This fuels not only the growth and innovation of the companies, but it also stimulates and grows the economy. Another reason is the stock market allows individuals to invest in companies and earn a return on these investments. Individuals can invest in the growth of a company and benefit from that company’s success, though there is always a risk of losing the investment. This concept can help create wealth for individuals, which in turn helps to stimulate the economy. The stock market is also used as a symbol of the quality of the economy. For instance, when stock prices are on the rise, it can be a sign of strong economic growth and a decline in prices can indicate economic weakness. As mentioned earlier, the stock market can allow companies to have more capital for their growth, therefore when companies use this capital to become successful and grow it creates more job opportunities to keep up with the growth and demand. This can reduce unemployment which can be a sign of a growing, prosperous economy. The stock market can also help play a role in helping people build wealth over time on less risky investments to supply funds for their retirements. The health and stability of the stock market has become crucial to the success of the economy.

The stock market crash of 1929 was a catastrophic event in the United States that signaled the beginning of the Great Depression. It occurred on October 24, 1929, also known as “Black Thursday”. The causes of the crash were numerous and complex, including speculative investing, overproduction in industry, a credit boom, and unequal distribution of wealth. The crash had widespread and devastating effects on the economy, including bank failures, unemployment, and a decrease in consumer spending. The effects of this crash were felt worldwide, especially in the United States, leading to a global economic downturn that lasted until the late 1930’s. Partially due to the lavish living and spending in the roaring 20’s the market crash devastated many people in the United States, becoming one of the multiple causes of the Great Depression, which was a period of extreme financial struggle for many people in the country. This led to many attempts by the government to create programs and amendments to help the country escape the Great Depression.

Black Thursday 1920’s Significance

Black Thursday was a key event that marked the beginning of the stock market crash of 1929. On Black Thursday, the market experienced a rapid decline in stock prices, with too many investors attempting to sell their shares out of panic. The impact of Black Thursday was devastating, it led to widespread bank failures, unemployment, and a decrease in consumer spending. Over the next several days after Black Thursday, the market continued to plunge, with Black Tuesday on October 29, 1929, being another of the most infamous days of the crash. On black Thursday and Tuesday, the NYSE experienced a sudden and massive sell-off of stocks, which triggered a chain reaction of panic selling. By the end of Black Tuesday, the stock market had lost billions of dollars in value, wiping out the savings of countless investors and causing a widespread financial crisis. These events had a lasting impact on the nation’s economic policies and financial regulations.

Black Thursday was triggered by several factors that had been building up in the years leading up to the event. One key factor in the crash was stock market speculation. In the years leading up to Black Thursday, there was a large number of investors buying stocks on margin, which means they were borrowing money to invest in stocks. This led to a bubble in the stock market, causing prices to rise far beyond their fundamental values. Another trigger was overproduction and underconsumption. In the 1920’s, there was a great deal of overproduction of goods in many industries, which led to a surplus. At the same time, many individuals were unable to afford the goods being produced, leading to underconsumption. This had to do with the unequal distribution of wealth, and created an imbalance in the economy that contributed to the crash. The banking system also had a lack of regulation and oversight, which allowed banks to engage in risky practices such as lending too much money to people who could not pay it back and would invest their loan in the stock market. This led to high levels of debt that could not be paid back after immense loses in the market.

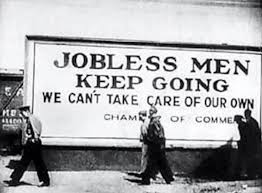

This is a significant event of the 1920’s because this era was known for its prosperity and lavish living by many people, even people that did not have the financial stability to live this way. This had a lot to do with the ability to make purchases on credit and the ability to get loans very easily from banks. The lives of Americans changed drastically after Black Thursday. The country went from many years of prosperity, quickly changing to a decade of financial turmoil that devastated many people throughout the country. This vast change in the economy stemming from Black Thursday hurt the citizens of the United States in many ways. Many people went bankrupt after suffering large monetary loses and losing their jobs from companies going under, causing many families not to be able to make ends meet. Poverty and homelessness became very widespread across the country, which led an overall feeling of hopelessness and despair. This also led to many other factors that hurt many people including a physiological depression, not just a financial depression, and health issues like malnutrition and relying on the government to help afford doctor bills. Black Thursday was the beginning of all of the problems caused by the market crash as well as the Great Depression. The prosperity of the 1920’s created a false sense of security and the thought that the economy could only get better from there causing many people to invest in the stock market. Therefore, the events of Black Thursday could not have been predicted and caused a chain reaction leading to one of the worst periods financially for American society.

Sources

Amadeo, K. (2021, January 27). The first day of the worst stock market crash in U.S. history. The Balance. Retrieved April 25, 2023, from https://www.thebalancemoney.com/black-thursday-1929-what-happened-and-what-caused-it-3305817

Pells, R. H., & Romer, C. D. (n.d.). Causes of the decline. Encyclopædia Britannica. Retrieved April 25, 2023, from https://www.britannica.com/event/Great-Depression/Causes-of-the-decline

Richardson, G. (n.d.). Stock market crash of 1929. Federal Reserve History. Retrieved April 25, 2023, from https://www.federalreservehistory.org/essays/stock-market-crash-of-1929