Introduction

The end of the 1920’s is infamously marked by The Wall Street Crash of 1929. The crash occurred for a number of reasons including but not limited to unregulated markets, individual debt, and faulty bank loans. The Crash caused hundreds of thousands of Americans to lose their life savings, but a few people benefited from the Crash. Albert Henry Wiggin, former president of Chase National Bank made millions using inside knowledge to buy and sell stocks in Chase National. While Wiggin cheated the market to make a fortune he was never held liable for his actions and led a fairly mundane life post crash.

Early Life and Career

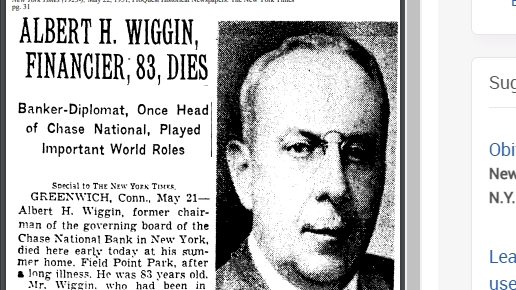

Albert Henry Wiggin was a Financier and majority shareholder of Chase national bank. Albert Henry Wiggin was born February 21, 1868 in Medfield Massachusetts. He graduated highschool in 1885 and immediately began a career in finance. His career started as a Boston bank clerk where he became involved with foreign affairs as he rose through the financial ranks. In 1904 Albert Henry Wiggin became the vice president of Chase bank and oversaw the bank’s expansion. Near the end of the 1910’s Albert Henry Wiggin oversaw the founding of Chase securities subsidiary. Albert Henry Wiggin also oversaw the merger of Chase with numerous financial institutions owned by Rockafeller.

The Great Crash of 1929

Albert Henry Wiggin and his management of Chase bank played a significant role in the stock market crash of 1929. Chase like other banks would participate in speculative loans that either made a significant amount of money or lost a significant amount of money. Chase participated in these loans and Wiggin, having private access to the bank’s financials, was able to determine that all the risky investments are not paying off and it can assume people will rush to withdraw money. Having no restrictions on the types of loans banks can be involved with encourages bank owners to act recklessly because they can only profit while the economy suffers. Because of Albert Henry Wiggin and his board of directors taking risks and losing the bank’s money the FDIC was created to insure personal accounts up to 250k in case a bank fails.

Wiggin’s most infamous moment came in the aftermath of the Great Crash of 1929. As the stock market began to collapse, Wiggin sold a significant portion of his own holdings, including shares in Chase National Bank, for a profit of around $4 million. This move sparked outrage among the public and led to calls for reform of the financial system. Some accused Wiggin of insider trading and profiting from the collapse of the market, while others defended him, arguing that he had simply been making smart business decisions. The fallout from the Great Crash eventually led to the establishment of the Securities and Exchange Commission (SEC), which was tasked with regulating the securities markets and preventing fraud and insider trading.

SEC Hearing

Albert Henry Wiggin had to provide a statement to the Senate Committee on Banking and Currency about his sell off of Chase bank stocks using insider knowledge. Albert Henry Wiggin provided his statement in November of 1933 where essentially admits to insider trading before it was a crime. The interview was short and established that Wiggin was aware of his power as a majority shareholder. The interviewer went on to use Wiggin’s decision to sell and accused Wiggin of notifying the board of directors to also sell based on private information.

“Is it fair to assume that the reasons that prompted you and Mr. Dahl to sell these holdings of your B.M.T common stock is the knowledge that you had of the financial condition of the company, which knowledge you acquired as the chairman of the finance committee and the chairman of the Board, respectively?”

Wiggn responds by indirectly admitting to insider trading “Yes, I had no inside information, except the knowledge that influenced my judgment was the maturity of notes, and everybody knew about it”. Albert Henry Wiggin tactic of short swing trading, selling company stock then rebuying it in a six month period because of exclusive knowledge, was legal but soon became illegal and coined as the “Wiggin loophole”.

Later Life and Legacy

After the Great Crash, Wiggin remained at the helm of Chase National Bank until his retirement in 1933. He continued to be involved in a number of business ventures and philanthropic activities throughout his life, including the creation of the Albert H. Wiggin Foundation, which supports medical research and education. Despite his controversial legacy, Wiggin is remembered as a pioneer in the field of finance and banking. His leadership at Chase National Bank helped to shape the modern banking industry, and his involvement in the New York Stock Exchange laid the groundwork for the Exchange’s continued success.

Wigmore, Barrie A. “Revisiting the October 1987 Crash.” Financial Analysts Journal 54, no. 1 (1998): 36–48. http://www.jstor.org/stable/4480051.

Painter, William H. “Section 16(d) of the Securities Exchange Act: Legislative Compromise or Loophole?” University of Pennsylvania Law Review 113, no. 3 (1965): 358–80.

Special to THE NEW YORK TIMES. “ALBERT H. WIGGIN, FINANCIER, 83, DIES: BANKER-DIPLOMAT, ONCE HEAD OF CHASE NATIONAL, PLAYED IMPORTANT WORLD ROLES STARTED CAREER AS A CLERK TESTIFIED BEFORE SENATE BODY.” New York Times (1923-), May 22, 1951. http://library.ramapo.edu:2048/login?url=https://www.proquest.com/historical-newspapers/albert-h-wiggin-financier-83-dies/docview/112236216/se-2.

https://www.sutori.com/en/story/albert-henry-wiggins–fj5AfW9C33oH6zwZkAz2hUmq

Ramapo College senior majoring in history. My concentration is in the 1920s machine politics in major cities. In particular the unsustainability of the machine politic model.